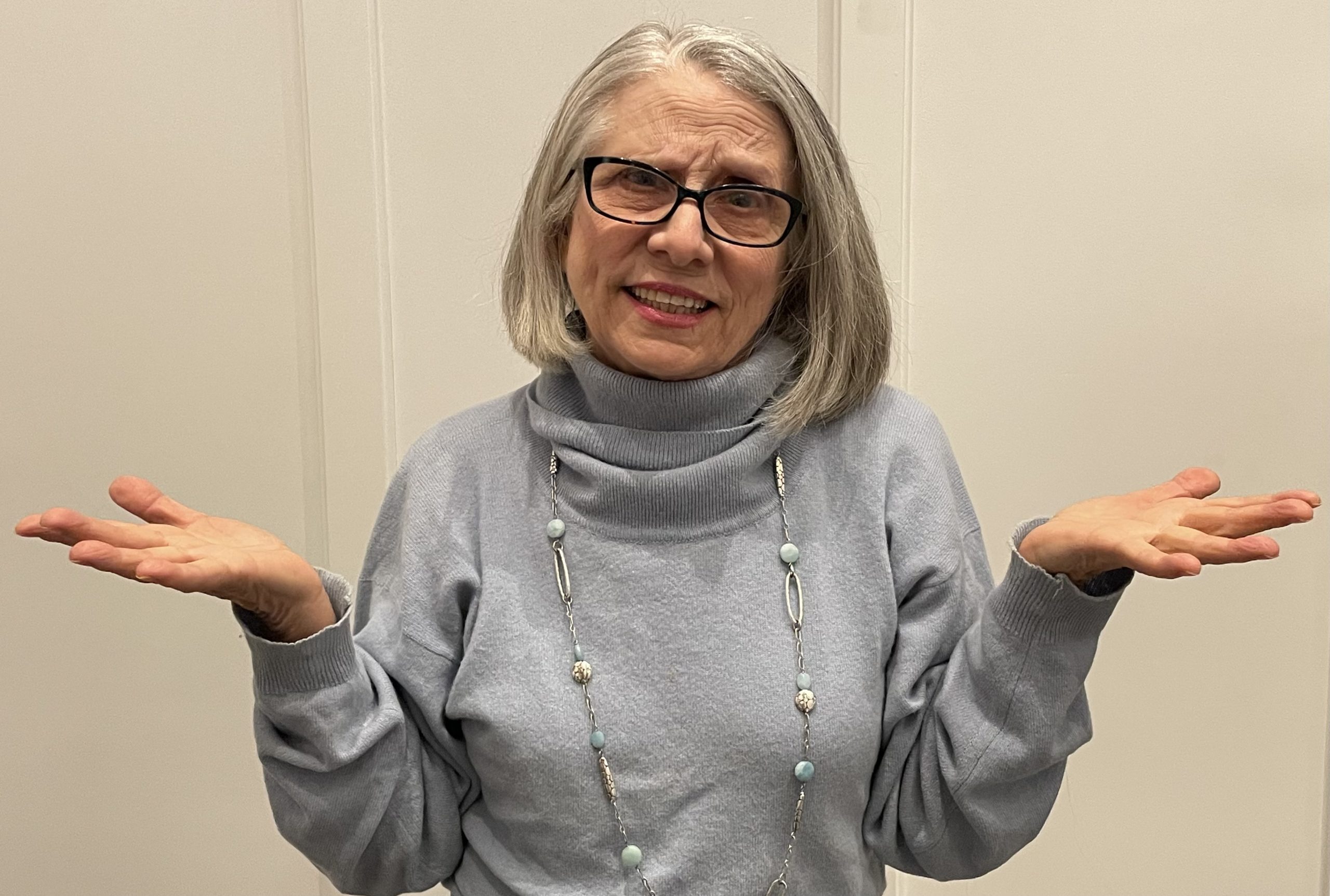

Are you perplexed about whether to buy first or sell first? There are pros and cons to each approach. However, we can discuss how to avoid the cons. For example, we can list your current property for sale with a contingency which allows you to find “suitable housing”. This would have an expiration date. In other words, if you did not secure a new property to purchase in time, you would be able to terminate your contract to sell (or get an extension on the expiration date). In a market like this when inventory is so minimal and demand is strong, buyers might be open to this type of contingency.

Are you perplexed about whether to buy first or sell first? There are pros and cons to each approach. However, we can discuss how to avoid the cons. For example, we can list your current property for sale with a contingency which allows you to find “suitable housing”. This would have an expiration date. In other words, if you did not secure a new property to purchase in time, you would be able to terminate your contract to sell (or get an extension on the expiration date). In a market like this when inventory is so minimal and demand is strong, buyers might be open to this type of contingency.You may decide that selling your existing home before buying a new one is a more financially prudent approach. This allows you to avoid the stress of potentially having two mortgage payments and provides a clear understanding of your budget for the new purchase. If you decide to do this and do not find your next property in time, I can guide you to some options for interim housing. If you sell first and live in interim housing, you can take your time to find the ideal home and will be negotiating from a stronger stance than if you are under a deadline.

Here’s a more detailed look at the pros and cons of each approach:

-

Pros:

- Avoids double mortgage payments: Selling first eliminates the need for two mortgage payments, which can be a significant financial burden.

- Clear budget for new purchase: Knowing the proceeds from your sale gives you a definite budget for the new home, preventing overspending.

- Less stress: Focuses on finding a new home without the pressure of selling first.

- Potentially better negotiating power: Being a cash buyer (or having a firm offer) can give you an advantage in negotiations.

- Avoids double mortgage payments: Selling first eliminates the need for two mortgage payments, which can be a significant financial burden.

-

Cons:

- Temporary housing: You may need to find temporary housing while you search for a new home.

- Moving twice: You’ll need to move twice, which can be inconvenient and costly.

- Children in school: If you have children in school, your choice of interim housing within that school community might be limited and, naturally, you wouldn’t want to disrupt their schooling.

- Temporary housing: You may need to find temporary housing while you search for a new home.

-

Pros:

- Seamless transition: You can move directly from your old home to the new one, avoiding temporary housing.

- No rush to buy: You can take your time to find the perfect home without the pressure of having to sell first.

- Seamless transition: You can move directly from your old home to the new one, avoiding temporary housing.

-

Cons:

- Risk of double mortgage payments: If you struggle to sell your existing home, you might face the financial strain of paying two mortgages.

- Pressure to sell: You may be pressured to sell quickly, potentially accepting a lower price.

- Market fluctuations: Market conditions can change between buying and selling, potentially affecting your sale price.

- Risk of double mortgage payments: If you struggle to sell your existing home, you might face the financial strain of paying two mortgages.